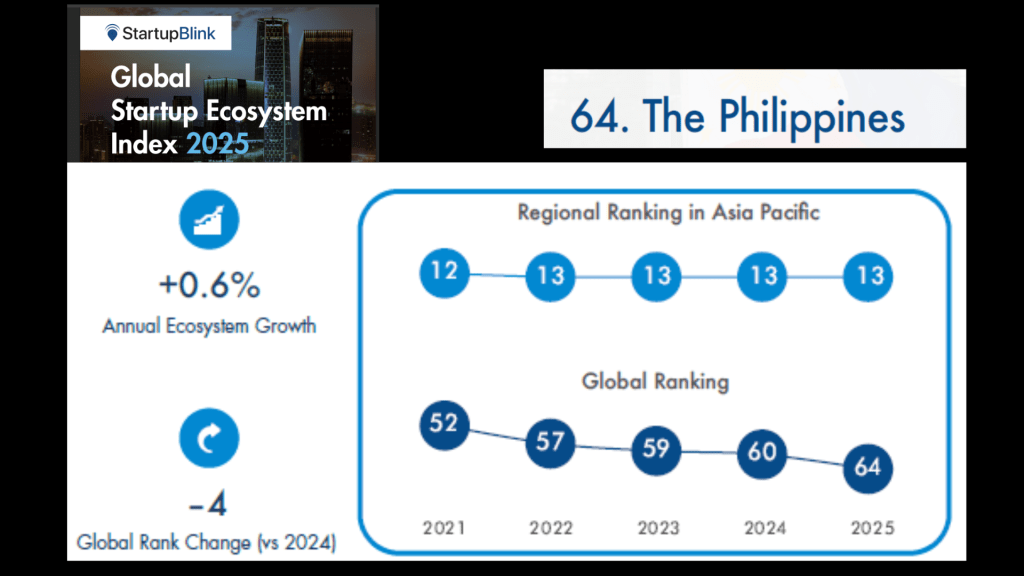

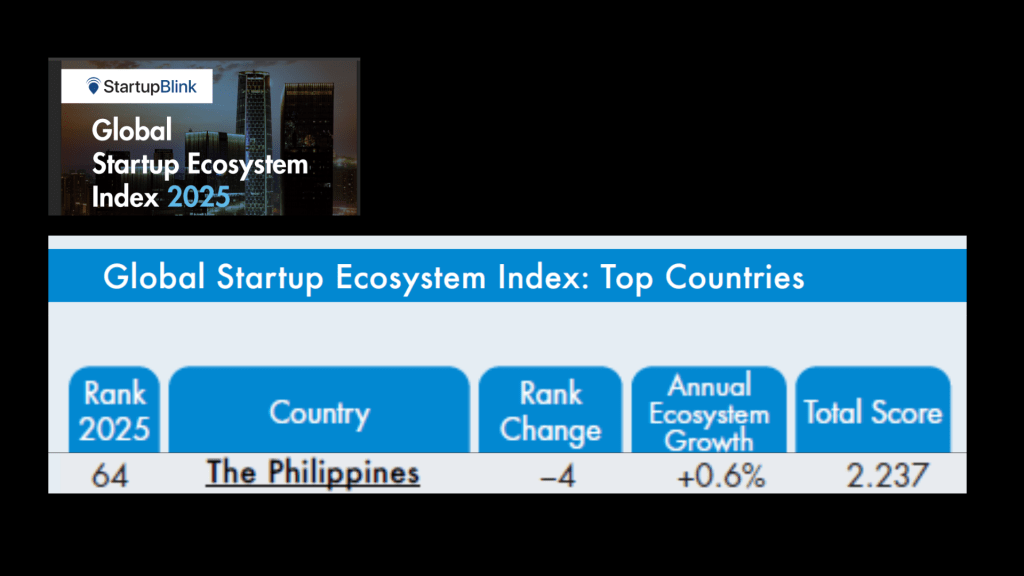

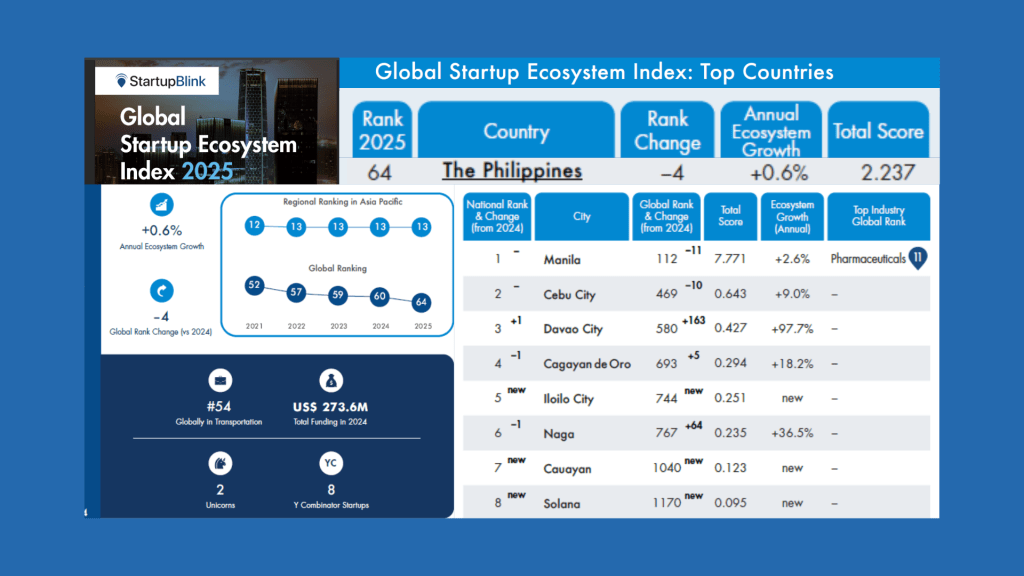

Manila, Philippines — The Philippines has dropped to 64th place in the Global Startup Ecosystem Index 2025, continuing a four-year downward trend that reflects persistent challenges in national startup policy execution and ecosystem growth. But from 5 cities last year, there are now 8 Philippine cities. The annual report, published by global research platform StartupBlink, ranks 118 countries and 1,473 cities based on startup activity, quality, and business environment.

KEY FINDINGS: Manila drops out of South East Asia’s top 5.

- The Philippines extends its four-year downward trend, dropping to 64th position globally and falling out of the global top 60 with a growth rate of less than 1%.

- The Philippines has the lowest growth rate in Southeast Asia.

- The country remains stable at 11th place in Asia and 6th in Southeast Asia.

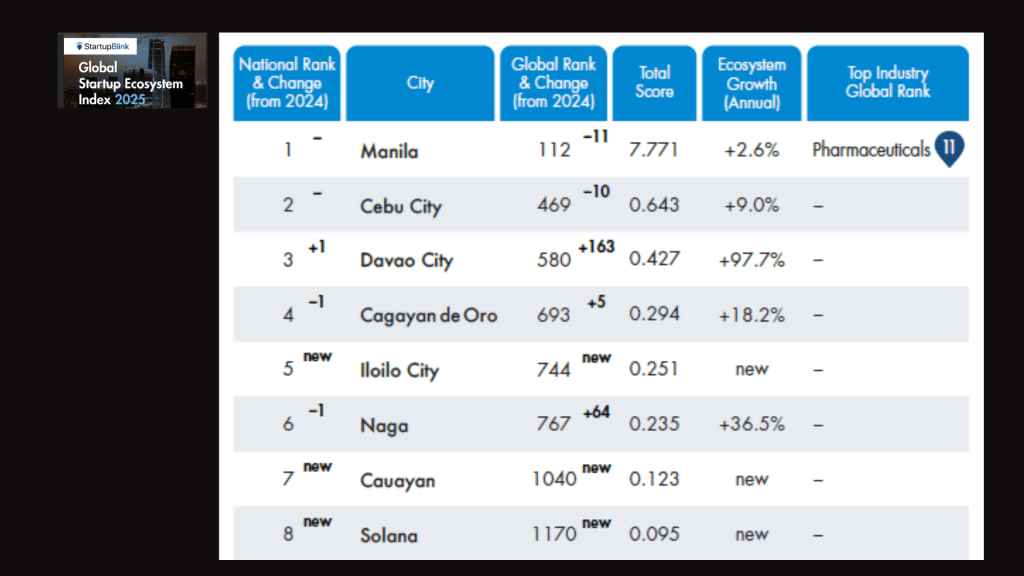

- The Philippines has six cities in the global top 1,000, half of them experiencing a climb in global rankings.

- The Philippines’ startup scene remains centralized in Manila, whose ecosystem is twelve times larger than Cebu City’s. This gap has more than doubled since 2020.

- Manila ranks 112th globally, falling eleven places and moving further away from the global top 100. This marks its second consecutive year of decline after exiting the top 100 in 2024.

- Manila has the lowest growth rate among the Philippine startup ecosystems, growing by less than 3%.

- Manila drops to 6th place in Southeast Asia, dropping out of the region’s top 5 for the first time since 2021. It is the only city in the region to experience a decline this year.

- Cebu City’s single-digit growth is not enough to maintain its upward momentum and it declines 10 spots to 469th.

- Davao City is the only Philippine city to make a national advancement, overtaking Cagayan de Oro’s spot to move into 4th place nationally. It also has the highest growth rate nationally.

- Iloilo City debuts in the global top 1,000.

- Manila excels in Pharmaceuticals, a subindustry of Healthtech, ranking 11th worldwide.

StartupBlink is a global startup research platform dedicated to mapping the key players and emerging leaders in the technology economy. By identifying successful startups and innovation hubs around the world, StartupBlink provides valuable insights into the dynamics of entrepreneurial growth. More than just a mapping tool, the platform plays an active role in supporting governments and corporations by offering strategic guidance to help them build and strengthen their local innovation ecosystems. Through data-driven analysis, StartupBlink empowers stakeholders to foster vibrant startup communities, stimulate economic development, and accelerate digital transformation—an approach that aligns closely with the vision of promoting inclusive innovation, particularly in emerging and underserved regions.

A Four-Year Decline

The Philippines’ global startup ecosystem ranking has steadily declined over the past four years, reflecting a downward trend in competitiveness and innovation performance. In 2022, the country ranked 55th, followed by 57th in 2023, 60th in 2024, and most recently, 64th in 2025. This consistent slide underscores the need for strategic reforms and stronger support systems to revitalize the national startup landscape and foster long-term growth.

With an annual ecosystem growth rate of only 0.6%, the Philippines now holds the lowest growth rate among countries evaluated in Southeast Asia and ranks 6th behind Singapore (4th), Malaysia (44th), Indonesia (45th), Thailand (57th), and Vietnam (62nd).

Global Startup Ecosystem Index 2025

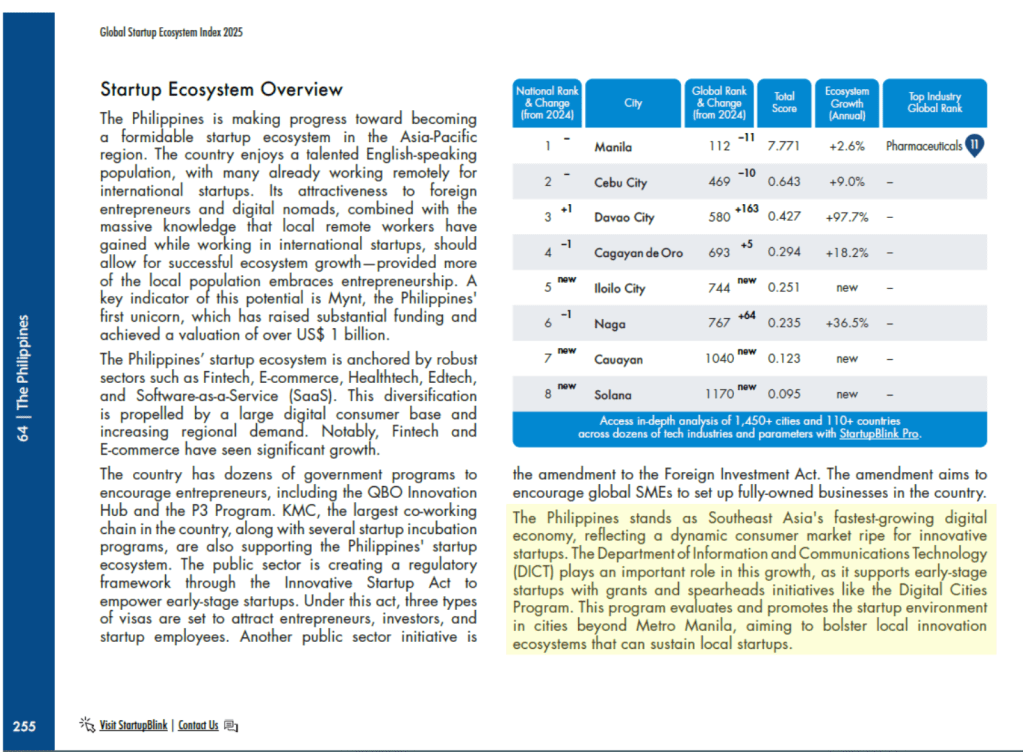

Startup Ecosystem Overview (Page 255 of the Startup Blink Report 2025)

The Philippines is making progress toward becoming a formidable startup ecosystem in the Asia-Pacific region. The country enjoys a talented English-speaking population, with many already working remotely for international startups. Its attractiveness to foreign entrepreneurs and digital nomads, combined with the massive knowledge that local remote workers have gained while working in international startups, should allow for successful ecosystem growth—provided more of the local population embraces entrepreneurship. A key indicator of this potential is Mynt, the Philippines’ first unicorn, which has raised substantial funding and achieved a valuation of over US$ 1 billion.

The Philippines’ startup ecosystem is anchored by robust sectors such as Fintech, E-commerce, Healthtech, Edtech, and Software-as-a-Service (SaaS). This diversification is propelled by a large digital consumer base and increasing regional demand. Notably, Fintech and E-commerce have seen significant growth.

The country has dozens of government programs to encourage entrepreneurs, including the QBO Innovation Hub and the P3 Program. KMC, the largest co-working chain in the country, along with several startup incubator programs, are also supporting the Philippines’ startup ecosystem. The public sector is creating a regulatory framework through the Innovative Startup Act to empower early-stage startups. Under this act, three types of visas are set to attract entrepreneurs, investors, and startup employees. Another public sector initiative is the amendment to the Foreign Investment Act. The amendment aims to encourage global SEOs to set up fully-owned businesses in the country.

The Philippines stands as Southeast Asia’s fastest-growing digital economy, reflecting a dynamic consumer market ripe for innovative startups. The Department of Information and Communications Technology (DICT) plays an important role in this growth, as it supports early-stage startups with grants and spearheads initiatives like the Digital Cities Program. This program develops and promotes the startup environment in cities beyond Metro Manila, aiming to bolster local innovation ecosystems that can sustain local startups.

Rise of Countryside Innovation

Despite the national dip, the report offers a bright spot: the number of Philippine cities included rose from 5 to 8, a sign of growing regional startup activity. These cities include:

- Manila – Rank 112 (11th globally in the Pharmaceuticals subindustry)

- Cebu City – Rank 469

- Davao City – Rank 580 (fastest-growing PH city with +97.7%)

- Cagayan de Oro – Rank 693

- Iloilo City – Rank 744 (new entrant)

- Naga – Rank 767

- Cauayan – Rank 1040

- Solana – Rank 1170 (located in Cagayan Valley)

This expansion in city representation signals growing innovation ecosystems outside Metro Manila, affirming advocacy efforts for countryside digital transformation and inclusive growth.

Manila experienced a decline in its global ranking in the Global Startup Ecosystem Index 2025, dropping from 108th in 2024 to 112th in 2025, a shift of four positions. This downturn mirrors the broader trend affecting the national startup landscape, as the Philippines also slipped from 60th to 64th place globally. While Manila continues to be the country’s top-ranked startup city, its dip in the rankings highlights the urgent need for renewed policy support, stronger startup traction, and sustained investment in both national and regional innovation infrastructure to regain momentum and global competitiveness.

Strategic Recommendations for Reversing the Decline and Empowering Regional Growth

To reclaim global competitiveness and build a resilient, inclusive digital economy, the Philippines must take bold, sustained action. The following are some strategic recommendations aligned with grassroots innovation and the principles of countryside digital development:

1. Invest in Regional Startup Infrastructure

- Establish Regional Innovation Hubs equipped with coworking spaces, maker labs, incubators, and shared digital tools to lower the barrier for rural innovators and entrepreneurs.

- Develop “Digital Free Zones” in second-tier cities and municipalities to attract local and foreign investors with tax incentives, startup grants, and light regulation.

- Accelerate broadband access and digital infrastructure in underserved areas, enabling equitable participation in the digital economy.

- Strengthen access to capital through public-private seed funding schemes and regional venture funds to empower early-stage startups in non-Metro Manila zones.

2. Support Community and Youth-Led Tech Hubs

- Institutionalize youth innovation programs at the high school and college level through partnerships with local universities, civic organizations, and tech leaders.

- Fund and mentor community-based youth startups through innovation competitions, hackathons, and bootcamps centered on local problem-solving.

- Scale tech-focused youth organizations and clubs, integrating them into city innovation planning boards and startup councils.

- Build digital leadership academies targeting rural youth, especially young women, to ensure inclusive participation in AI, fintech, agri-tech, and creative tech industries.

3. Enable Local ICT Councils to Scale Innovation

- Empower and fund ICT councils in all provinces and cities, institutionalizing their role as key facilitators of innovation ecosystems at the local level.

- Provide capacity-building programs for council leaders to align them with national and global startup ecosystem best practices.

- Encourage inter-LGU collaboration and digital ecosystem clustering through regional startup roadmaps and shared tech infrastructure.

- Use data and metrics to track innovation performance per region, empowering ICT councils to drive evidence-based policymaking and investment attraction.

These steps reflect a clear roadmap toward what we have long advocated: a digitally empowered, regionally balanced innovation economy. By fostering inclusive ecosystems that embrace youth, empower local leaders, and connect every Filipino to global opportunities, the Philippines can transform its digital trajectory—and reclaim its place as a Southeast Asian startup powerhouse.

The Philippines may have lost ground globally, but the rise of cities like Davao, Iloilo, and Solana reflects a hopeful direction: an ecosystem rooted in grassroots, inclusive, and sustainable digital progress.

Official Key Parameters:

Based on the Global Startup Ecosystem Index 2025, the official ranking methodology uses a comprehensive algorithm built on three key parameters, confirmed directly from your uploaded document:

- Quantity

- Measures the activity level of the ecosystem, such as the number of startups, coworking spaces, accelerators, and support institutions.

- Quality

- Assesses the impact and success of the ecosystem, including metrics like funding, exits, media presence, unicorns, and global visibility.

- Business Environment

- Evaluates how supportive and enabling the general environment is for startups.

- Includes infrastructure, legal frameworks, safety, cost of living, and newly added indicators such as Corporate Startup Activity by location.

In 2025, the algorithm also introduced:

- A new metric: Ecosystem Growth, reflecting year-on-year performance.

- Adjusted city-level parameter weights: Startups (+50%), Traction (+25%), and Employees (–50%).

These parameters are applied across 118 countries and 1,473 cities, making it the most comprehensive startup ecosystem index globally.

The Global Startup Ecosystem Index by StartupBlink has been updated annually since 2017 and currently ranks the startup ecosystems of

1,473 Cities and 118 Countries. It is built using hundreds of thousands of data points processed by an algorithm which takes into account several dozen sets of parameters comprising three subscores: Quantity (measuring the activity level of the ecosystem), Quality (assessing the impact and success of the activity in the ecosystem), and Business Environment (evaluating how supportive the overall conditions are for startup growth). StartupBlink has partnered with more than 100 Ecosystem partners, most of which are government agencies, and receive data about their ecosystems.

The insights of report are derived from an extensive database comprising hundreds of thousands of startup ecosystem entities. This robust dataset enables StartupBlink to support governments, corporations, and stakeholders in making informed decisions that promote innovation and economic development.

For more insights, visit startupblink.com.

Leave a comment